With Christine Farley and Pam Samuelson: our brief addresses the effect of Google v. Oracle, which the Second Circuit has explicitly asked for more briefing about. I would expect other amicus interest, including on Goldsmith's side, given the stakes of whether Gv.O is a software case or a fair use case at heart.

Friday, April 30, 2021

Wednesday, April 28, 2021

Nominative fair use (maybe) and Amazon

I've recently seen two examples of the following phenomenon: off of Amazon, an advertiser uses images of its product with another well-known product, and they do go together, but on Amazon, the advertising is different. Anyone know if there's an Amazon policy driving this? For those circuits that require the advertiser to have a good reason to refer to the trademark owner in order to justify nominative fair use, the Amazon ads would seem to show it's possible to advertise without using the other mark. Special kudos to the Angelus paint for using an all-red shoe on Amazon, which isn’t a “use” of the Louboutin mark according to the 2d Circuit. Clever!

Angelus shoe paint off Amazon (and from some third party sellers on Amazon):

|

Thursday, April 22, 2021

DoorDash invites users to get their grub on

Screenshot of mobile search results for "Grubhub." Note also "Great Grubs" in the DoorDash blurb. I don't think it's unlawful, but it's kind of tacky:

Monday, April 19, 2021

2020-2021 Georgetown Law Technology Review Student Writing Competition

2020-2021 TOPIC

Students are invited to submit papers addressing a legal or public policy question relating to emerging and sustained challenges to legal and political structures created by online platforms, digital services, and other emerging technologies.

Example topics include: questions relating to the adequacy of federal and state agency regulatory and adjudication structures to address current and emerging technologies; the scope of current agency jurisdiction over digital technologies and practices; whether current legal structures effectively protect consumers and vulnerable populations. Students are invited to submit papers that examine proposed or newly-enacted laws related to these questions, or to propose novel legal structures to engage with current gaps.

Preference will be given to papers that are relevant to current legal and public policy debates around technology or present an original perspective.

PRIZE

Up to three winners will be selected, with a First Prize of $4,000, a Second Prize of $2,000, and a Third Prize of $1,000.

Winning papers may be selected for publication in The Georgetown Law Technology Review.

COMPETITION RULES

Papers will be accepted from students enrolled at any ABA-accredited law school in the United States during the 2020-2021 academic year. The paper must be the author’s own work, although students may incorporate feedback received as part of an academic course or supervised writing project.

The paper must not have been published or committed for publication in another journal; The Georgetown Law Technology Review must have the first right of publication for any winning essay.

Papers will be evaluated based on thoroughness of research and analysis, relevance to the competition topic, relevance to current legal and/ or public policy debates, originality of thought, and clarity of expression.

Papers must be 4,000-7,500 words (not including footnotes) and be submitted in Times New Roman Size 12 font, double spaced. Footnotes must conform to the 20th edition of The Bluebook: A Uniform System of Citation. Papers must be in English.

COMPETITION DEADLINE

The deadline for submissions is 11:59 p.m. EST on May 31, 2021.

Papers must be submitted via email to [email protected] with the email subject line “Writing Competition”.

The file must be submitted in Word format, with the file named in the format “LastName_FirstName_WritingCompetition”.

Papers must be preceded by a cover page (included in the same Word file) containing the following information:

Full Name of Author

Name of ABA-accredited Law School

Graduation Year

Email Address

Phone Number

Word Count

The following affirmation: “I affirm that this paper is an original work of scholarship authored by me. The paper (or any variation thereof authored by me) has not been published, or committed for publication, in any other publication. If this paper is selected as a winner, I grant The Georgetown Law Technology Review the right of first publication of the paper. I have read and agree to the Competition Rules set forth at www.georgetowntech.org/writingcompetition.”

Entrant’s name and law school shall only appear on the cover page. Papers shall contain no identifying information.

NOTIFICATION OF WINNER

The winner will be notified by phone or email on or before August 31, 2021.

FINE PRINT

The judges’ decisions are final.

Winners will be required to submit a completed W-9, affidavit of eligibility, tax acknowledgment and liability release for tax purposes as a condition to receiving the cash prize. All forms must be completed and returned via email within 14 days of receipt, or prizes will be considered forfeited and another winner may be named.

The authors of papers that are selected for publication will be required to sign an agreement warranting the entry’s originality and granting the GLTR first publication rights.

If a potential winner does not respond within 14 days of the first attempt to contact him or her, or if the contact is returned as non-deliverable, the potential winner forfeits all rights to be named as a winner or receive a prize, and an alternate winner may be chosen.

Entrants may submit multiple entries per year. Jointly authored papers are eligible, provided all authors meet the eligibility requirements for the competition. If a winning paper has more than one author, the prize will be split equally among the co-authors.

Winners will be solely responsible for all federal, state, local or other taxes, if any such taxes apply. Cash prizes will only be paid in US Dollars by way of check or bank transfer. Any fees that may be charged from time to time by the relevant bank will be deducted from the prize money.

Georgetown Law’s Institute for Technology Law & Policy, the Georgetown Technology Law Review and BSA | The Software Alliance (together “the Organizers”) are not responsible for incorrect or inaccurate entry information, late, lost or misdirected entries, or for computer errors or technical failures, including by reason of any bug, computer virus or other failure.

In the unlikely event that no entries are of sufficient quality to merit an award, the Organizers reserve the right not to award any prizes.

The Writing Competition is governed by U.S. law and all relevant federal, state and local rules and regulations apply. By entering, all entrants agree that the competition shall be governed by the laws of the District of Columbia and that the courts of the District of Columbia shall have exclusive jurisdiction for any dispute or litigation relating to or arising from the competition. Void where prohibited by law.

By participating, each entrant agrees to the rules of the Writing Competition and the decisions of the Organizers and releases, discharges and holds harmless the Organizers and each of their respective officers, directors, members, employees, independent contractors, agents, representatives, successors and assigns from any and all liability whatsoever in connection with the Writing Competition, including without limitation legal claims, costs, injuries, loss or damages, demands or actions of any kind.

This Writing Competition may be cancelled, modified or terminated for any reason.

Questions?

Email [email protected]

Friday, April 16, 2021

The 4th Circuit makes trademark use more contextual

Combe Inc. v. Dr. August Wolff Gmbh & Co. Kg Arzneimittel, No. 19-1674 (4th Cir. Apr. 13, 2021)

Not only is this case a good demonstration that courts are willing

to give broad rights to marks based on similarities in descriptive elements (here the VAGI- formative in VAGISIL for preparations for use in the vagina), it

also has relevance for the current discussion of “use as a mark.” As Grace

McLaughlin argues in her recent Fanciful Failures, there are situations

where putting something in the trademark “spot” for a product doesn’t

necessarily mean that consumers will understand it as a mark. Perhaps

surprisingly, the district court and the court of appeals endorse precisely

that view here:

Further,

the district court appropriately gave little weight to generic Vagicaine products

sold by big-box retailers because consumers do not associate them “as a source-identifying

brand,” but instead recognize them as the “generic product seek[ing] to imitate

VAGISIL’s anti-itch cream.”

Wednesday, April 14, 2021

ICANN working group report on TM rights protection mechanisms in all gTLDs now open for comment

Link to report and comment mechanisms. The Working Group did not recommend expanding trademark claimants' preemptive/pre-registration notice rights to include broad matching or algorithmically generated close variants (misses a match by one letter, for example), but I expect that's still on the agenda for some proponents. One of the things that we found out in the process was that the most-searched-for "trademarks," of the set entered into the database maintained for the purpose of simplifying rights claims, were, in descending order: smart, forex, hotel, one, love, cloud, nyc, london, abc, luxury. That doesn't make the database all junk, but it does highlight that new rights protection mechanisms are always also new pathways to abusive claims, and those tradeoffs should be confronted head-on rather than assumed not to exist. The fact that the database is secret doesn't help (though much of its content could be inferred from registration attempts that receive claims notices).

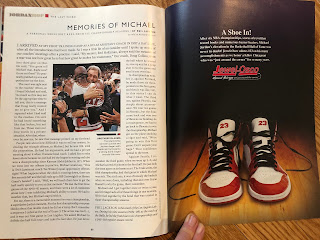

Michael Jordan's ROP claims against ads in the SI special issue on him

I just heard this discussed on a GALA (Global Advertising Lawyers Alliance, recommended for international updates) event, and fortuitously I'd decided to get my hands on a copy of the actual special issue. One thing I hadn't realized from the cases is that there were only three ads in the entire special issue. The carmaker must feel good about its choices, but I have to say that if I were the other advertisers I might feel betrayed by SI and the supposed special sponsorship opportunity offered. It must be a percentage-of-ads-triggering-lawsuits record!

|

| cover |

|

| ad #2, opposite table of contents |

|

| ad #3, inside back cover |

Substantiation issues?

This poster in a local dry cleaner's, produced by a larger association, gave me pause: I believe that dry cleaning likely destroys most viruses present ... but how many viruses are likely to be present? Does the claim of "effective, easier and safer" imply that this is a good way to decrease risks, especially covid-related risks now that we understand that most spread is aerosol-based?

Monday, April 12, 2021

Recent reading: on brands and sumptuary codes

Inspired by Kali Murray’s great comments at this past week’s Race and IP conference, some notes from recent reading:

Virginia DeJohn Anderson, Creatures of Empire: How Domestic

Animals Transformed Early America

Relevant to TM and sumptuary laws (addressed in Barton Beebe's excellent work), Anderson recounts how in

some places Native people were barred from marking their own livestock, but

punished if they killed a marked animal. In other places/times, both Indians

and colonists were required to use their own brands to identify animals, but

who got away with violating the rules was unsurprisingly racialized.

Relevant quotes (footnotes omitted):

In the Chesapeake, as in England,

livestock owners could protect their rights to mobile property by marking their

animals. A few seventeenth-century planters branded cattle on the horn, but

most colonists preferred to clip animals’ ears. Virtually every family had its

own earmark, involving some combination of slits, holes, half-circles, forks,

“fleur-de-lis,” or cropping. They registered their marks at the county court,

where the information was recorded to help in identifying strays. Colonists

regarded earmarks as a form of personal property to be handed down through the

generations. In 1658 when Thomas Gerard neglected to register his earmark and

William Evans then used it himself, an angry Gerard took the case to Maryland’s

Provincial Court. Gerard protested that his mark was “of a long standing,

although not heretofore recorded” and had been “injuriously taken” from him.

Since Evans had not yet used it, Gerard argued, the earmark ought to be

restored to its rightful, if negligent, owner. Far from finding this a

frivolous proceeding, Maryland’s governor not only heard the case but, in an

unusual move, polled the councillors for their individual opinions. Four of the

five officials sided with Evans, noting his compliance with the law. The

governor, however, found merit in Gerard’s emotional plea and asked Evans to

relinquish his claim. Evans did so, and a chastened Gerard promptly recorded

the mark in his own name….

The Bay Colony legislature tried to

minimize contention with a 1634 measure stipulating that trespassing swine

would be dealt with according to the rules of the town in which the animals had

been found, but this did not help aggrieved parties discover where the beasts

actually belonged. Thus in 1647 the General Court required owners to paint a

symbol with pitch on the flanks of livestock designating the town where they

lived. Just as earmarks labeled livestock as private property, these town

marks, or in some cases brands, identified them as animal members of a

community. Yet town marks also symbolized the attenuated control of each

community over its animals’ whereabouts….

Natick’s herds had grown sufficiently numerous by 1670 that its inhabitants [“praying Indians”] petitioned the Massachusetts General Court to assign them a town brand to distinguish their animals from those belonging to neighboring settlements. Although some form of the initial letter of a town’s name customarily served as a brand mark for English communities, magistrates designated a bow and arrow for Natick—an ambiguous symbol at best, suggesting that no amount of acculturation would fully erase from English minds the sense that Indians remained fundamentally different from colonists….

Indians knew that colonists

identified their animals by earmarks; whether native owners would be allowed to

do the same remained an open question for several decades. A story that

probably originated in Virginia and later circulated in England suggested that

by the 1650s earmarks had at least become a topic of conversation between

Indians and colonists. Informed by irate Englishmen that his followers had been

stealing hogs, a sachem reportedly countered that colonists had been just as

busy killing the Indians’ deer. The English reminded him that earmarks

identified the hogs as private property but deer displayed no comparable sign

of ownership. “Tis true indeed, none of my deer are marked,” the Indian coolly

replied, “and by that [you] may know them to be mine: and when you meet with

any that are marked, you may do with them what you please; for they are none of

mine.” Possibly apocryphal, the anecdote nevertheless fairly represented Indian

wit and addressed a topic of current interest to both parties….

Once Chesapeake-area Indians owned

swine, the virtues of marking them became self-evident. Unmarked hogs offered

tempting targets for colonial thieves, who needed only to clip the ears of such

creatures to claim them as their own. Given the propensity of colonists to

steal livestock from one another, this was no idle threat. Earmarks also

distinguished Indian hogs from feral swine. Native owners could have marked

their beasts at any time, but these marks would not provide genuine protection

until colonial authorities recognized them as legitimate symbols of private

property. Virginia’s legislature did not make such a concession until 1674

when, in a measure aimed at curbing Indian theft of English animals, it ordered

county courts to designate “a perticuler marke” for inhabitants of each native

town to use on their swine. Assigning a mark to towns instead of individuals

may have indicated that Indians regarded swine as common property, or simply

that the burgesses failed to make distinctions among native owners. Whether

earmarks actually enabled Indians to defend their animal property is unclear.

Oddly enough, when faced with the

same circumstances, New England magistrates adopted precisely the opposite

tactic. Although there is evidence to suggest that some Indians in Rhode Island

took the initiative to begin marking their swine, one by one New England legislatures

moved to prohibit the practice. Between 1666 and 1672, Rhode Island, Plymouth,

and Massachusetts all ordered that “noe Indian shall give any eare marke to his

swine upon the penalty of the forfeiture of such swine.” Indian hogs brought to

market had to have uncut ears; native sellers of pork likewise had to produce

intact ears to prove ownership. The ostensible reason for this policy was to

prevent Indians from profiting from stolen English swine, but its more obvious

effects were to complicate Indians’ market activity and to render Indian

animals vulnerable to unscrupulous colonists who merely had to mark the

creatures’ uncut ears and claim possession. There was also no way for Indians

to distinguish their swine from feral beasts that, if less numerous in New

England than in the Chesapeake, still roamed the woods and were regarded by

colonists as fair game. If Christian Indians in Natick, allowed to have a town

brand for their animals, were exempted from the earmark prohibition in

recognition of their efforts at acculturation, they would have been the

exception that proved the rule. New England magistrates otherwise denied

Indians use of the acknowledged symbol of legitimate ownership, as if it ought

to signify their progress toward civility rather than their hogs’ status as

private property.

Friday, April 09, 2021

Harvard Journal of Sports & Entertainment law seeking submissions

The Harvard Journal of Sports and Entertainment Law (JSEL) is accepting submissions for Volume 13, set to publish during AY21-22. Submissions for Issue 1 will be reviewed and accepted through August 2021. JSEL is looking for articles on topics related to sports and entertainment law, and especially encourages law professors to send in articles. We want to err on the side of encouraging submissions, so if you have a nearly completed draft that just needs to be fleshed out a bit more, we would prefer to be able to review it.

Thursday, April 08, 2021

Reading list: native ad disclosures that work?

Eyal Peer & Dalia Shilian, Improving Consumers’ Ability To Detect Native AdvertisingUsing Identified Disclosure:

Native advertising of online content, such as articles embedded within news websites, is a covert attempt by marketers to affect consumer attitudes and behavior. Because such marketing can have detrimental consequences for consumers, regulators worldwide have begun mandating that disclosures accompany marketing content. Despite these mandated disclosures, studies repeatedly find that consumers still fail to detect native ads even when they include various disclosure labels. We argue that the failure of these and other such disclosures, (e.g., software licensing), results from consumers becoming so habituated to these notices that they fail to recognize or use them effectively. We propose an improved form of disclosure for native ads requiring explicit identification of the name of the company or marketing agent paying for the non-original content. Identified disclosure can be more effective because it is more salient and can vary between ads and platforms. In two studies, we show how adding identified disclosures to native advertising increases detection rates significantly and consistently. We also discuss important implications arising from using smart disclosures for consumer protection.

Payoff: at the end of the article, the authors note that

Israel’s consumer protection authority has adopted its recommendations as a

native advertising disclosure standard.

Wednesday, April 07, 2021

a handful of Google v. Oracle thoughts: categories, microworks, and market circularity

A couple of small Google v. Oracle thoughts: The majority clearly says that, as with other categories of protected works, distinctions can be made within the categories, drawing lines “among” computer programs, books, and films. Not all literary works are the same; Infinite Jest gets a different kind of copyright protection than my emails do. Likewise, while the recent Warhol case at times seems to imply that the derivative works right overrides fair use, the same GvO passage says that copyright provides both reproduction and derivative works rights, but also subjects all works to fair use.

One of my minor obsessions is “courts that reproduce the entire works in suit in the opinion”—whether they find for the plaintiff or the defendant, and whether they rule on substantial similarity or fair use, they never even consider whether it’s ok to do so. It’s obviously a good idea for purposes of understanding what the law is—a description of a song or picture will never allow a subsequent reader to understand what the protectable expression in the song or picture was—and I think obviously fair, but it’s amusing to me that it happens without anyone pointing out that this must be in reliance on fair use.

Anyway, in GvO, Justice Breyer instead reproduces an entire short story, which was just minding its own business and had nothing to do with the case, in two different languages no less. And he does so in the course of suggesting that the scope of fair use would be more limited with respect to that short story than to a sentence of the same length in a longer novel. I think that’s a troubling conclusion—Justin Hughes has written very well about the problem of “microworks” and the right result would probably be to say that the book of stories from which that story comes should be the proper unit of analysis for factor three. Update: based on the statutory language, any claim against the US could not be brought under the CASE Act but would have to proceed in the Court of Claims. But now I ask: Can casebook authors use this portion of the case without fear?

On factor four, it was nice to see acknowledgement that (1)

the licensing package Oracle offered was very different from what Google

ultimately copied, and thus didn’t show market harm from what Google

actually copied and (2) this was a circularity problem, which should be

avoided. Also, relevant to the “mixed question of law and fact” issue, the

majority says: “the jury’s fair use determination means that neither Sun’s

effort to obtain a license nor Oracle’s conflicting evidence can overcome

evidence indicating that, at a minimum, it would have been difficult for Sun to

enter the smartphone market, even had Google not used portions of the Sun Java

API.” I think that means that the jury verdict must be interpreted to have

favored Google on factor four, resolving the factual part of factor four in its

favor. I am not sure what that means for summary judgment in future cases,

especially if factor one remains more of a legal question.