Chiusa v. Stubenrauch, 2022 WL 2793579, No. 3:21-cv-00545

(M.D. Tenn. Jul. 15, 2022)

The parties in this case are former business associates,

which is one reason there are so many different claims. Stubenrauch is the

controlling member of CV, which makes and sells unusually colorful “residential

fixtures and décor made from aged and/or etched copper.”

|

| examples of finishes from opinion |

Chiusa is the owner and operator of CC, which “create[es]

commercial websites and sell[s] various products for manufacturers.”

The parties worked together to launch a website selling

Stubenrauch’s copper lampshades and mirrors. They then agreed that Chiusa would

create and operate a website, colorcopper.com, marketing and distributing Stubenrauch’s

copper sheets “to a new industry for copper countertops, bar tops and kitchen

backsplash.” Though the parties went forward, “they never signed a formal

written document memorializing and defining the nature of their business

relationship.” [Reminds me of the recent Twitter meme: terrify your lawyer in

five words. “There’s no written agreement” will do it.]

CC has a recent trademark registration for a design mark

“consist[ing] of the stylized wording ‘COLOR COPPER.COM”, [with] a diamond

shape between the wording ‘COLOR’ and ‘COPPER’ made up of four smaller

diamonds, each diamond having a pattern inside of it,” COPPER.COM disclaimed.

Chiusa alleged that it was a normal supplier-distributor relationship,

in which consumers would order through the colorcopper.com website he

controlled, Stubenrauch and CV would then fill the order and usually dropship

the finished product directly to the customer using Chiusa’s shipping account except

when they shipped to Chiusa who’d send it on.

After nearly a decade, however, Stubenrauch contacted

another man, Wasser, about creating a new website for CV. Stubenrauch told

Wasser that he was free to use photos and text from Chiusa’s website. Chiusa

eventually discovered this and declined an offer to work with Wasser, who allegedly

“proceeded to misappropriate the moneys coming in through the website while

never delivering any copper products to customers,” eventually “abscond[ing]

with the money.”

Chiusa, allegedly concerned for his own reputation, took

down CC’s http://www.colorcopper.com and also refused to sell the site to

Stubenrauch. “In in an attempt to right the ship and offset his losses,

Stubenrauch created a new website.” The new site, coloredcopper.com, apparenlty

used many of the photographs that Chiusa had used and reproduced at least some

portions of the original site’s text.

Chiusa has a copyright registration for the website obtained

during this dispute. “The certificate expressly states that the ‘[p]revious

version of the website’ is excluded from the registration, but that language is

not accompanied by any clarification regarding which elements were new, and

therefore (at least potentially) covered by the registration, and which were

old, and therefore subject to the disclaimer.” Chiusa also has a registration for a brochure,

stating that he created “text, photograph(s), [and] artwork on p.1” therein. “The

copy of the brochure deposited with the copyright office is 50 pages long and

consists primarily of photographs depicting products and product features

purportedly available from ‘ColorCopper.com.’”

The site also uses a logo that is allegedly too similar to

CC’s logo.

“Stubenrauch also allegedly created a new website directly

competing with another of Chiusa’s ventures,” an “ancillary business selling

various types of epoxy products over the internet” under the trade name

ULTRACLEAR EPOXY. Stubenrauch’s epoxy website also used language that appeared to

be taken directly from Chiusa’s site. There’s a similar copyright registration

for this site.

Chiusa’s claims: willful copyright infringement; breach of

the oral distribution agreement; trademark infringement, false advertising, trade

dress/trade name infringement, and false designation of origin undre the Lanham

Act; a Tennessee Consumer Protection Act claim; and conversion.

Copyright: Defendants argued that plaintiffs didn’t

sufficiently identify protected elements of the websites and brochure, given

that the registrations provided “little, if any, guidance for sorting the

claimed elements from the non-claimed elements. Moreover, there are likely some

elements of the underlying works that are not only not Chiusa’s, but are not

protectable by copyright at all…. [S]imple facts and common turns of phrase

that appear in marketing materials—for example, about the features of a material

or technology—are not protected by copyright.”

The court noted that functional/utilitarian features of marketing

materials might be excluded from protection, citing Star Athletica.

Given the pleading standard, dismissal at this stage was not

warranted, even though defendants might well be right that many elements of the

underlying websites were purely functional and/or factual and are not entitled

to copyright protection. “[O]ther elements, such as the visual depictions and

creative verbal descriptions included on the websites and in the brochure, are

plausibly entitled to protection. While the plaintiffs could have been more

precise in breaking down all of the constituent elements for which they are

asserting protection, . . . plaintiffs have specifically identified at least

some plausibly protected elements in the websites and brochure that were

replicated in some of the defendants’ materials,” including specific photos

from the Chiusa website.

Likewise, the epoxy website included “a number of full

sentences that appear verbatim (or nearly so) on the plaintiffs’ site,” e.g.:

[UltraClear epoxy/DuraClear™ epoxy]

boasts the most advanced level of shine, gloss, reflectivity, clarity and

depth, and it locks in those optical qualities forever. The most sophisticated

system of synthetic polymeric-based protection available. Our Commercial-grade

epoxy is engineered specifically for Bar Tops, Tabletops & Countertops.

This text contained “some creative elements that are

plausibly entitled to protection, such that outright copying would be

prohibited.” In a footnote, the court noted defendants’ argument that the

overlapping text was selected for SEO reasons, not expression-based reasons,

but the court declined to resolve whether that mattered to protectability, “because

the plaintiffs have sufficiently pleaded infringement of other elements.” Still,

“the cited text is neither an unintelligible list of keywords nor separate from

the user-facing portions of the websites, and the defendants identify no

caselaw suggesting that such language becomes exempt from copyright protection

merely because its author had search engine results in mind, among the other

functions of the text, when writing it.”

Likewise, at this stage only, the court rejected the

argument that plaintiffs failed to plead ownership of the copied elements. At

least for the copper website and the brochure, the delay in registration could

prevent any presumption of ownership based on the prima facie validity of the

registration. “The lack of that

presumption, however, is primarily a hindrance to a plaintiff’s ability to make

his case, not his ability to plead it. Regardless of any delay in seeking

registration, a plaintiff can state a claim by sufficiently pleading actual

ownership.” At this stage, the bare-bones allegations that the “copyrighted

pictures, images, text, and artwork embodied” in the websites and brochure were

“either created, taken, bought by, or assigned to” the plaintiffs were barely

enough, given that it was plausible that plaintiffs might have come to hold the

rights to different elements in different ways, e.g., Chiusa could have written

some text himself, purchased rights to a photo, and commissioned another photo

as a work for hire.

The court cautioned that it was paying attention to the

ownership issue, resolution of which would likely require “considerably more

detail than they have pleaded.” Still, “defendants have not identified any

caselaw suggesting that, in order to state a plausible claim for relief for

copyright infringement, a plaintiff must plead not only ownership itself but

also the detailed story of how the plaintiff obtained that ownership.”

Trademark: Defendants argued that “color copper” is just an

ordinary and straightforward way to describe copper that has been treated to

have a striking color. At this stage, the court need not resolve whether plaintiffs

pled—or could prove—any rights in “color copper” the phrase on its own or colorcopper.com,

the registered design mark sufficed to plead ownership of a protectable mark.

The registration was rebuttably presumed valid.

As to the phrase “color copper,” the court rejected

plaintiffs’ argument that it was arbitrary. Plaintiffs reaosned that “a mere

description of the copper would refer to it as ‘colored’ or ‘colorful,’ rather

than using ‘color’ as an adjective.” [Note effects on the scope of their rights

against descriptive uses.] No: “a grammatically flawed description is still a

description. A consumer who heard the phrase ‘color copper’ would reasonably

assume that it referred to copper that was, for some reason, not the ordinary

color—and they would be correct.” Still, plaintiffs plausibly pled secondary

meaning [at least of the design mark, I think[ and also plausibly pled that at

least some of defendants’ materials infringed.

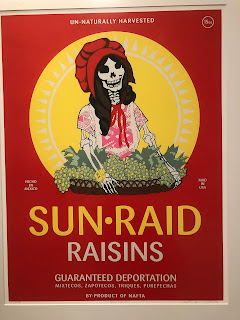

|

| comparison of marks |

The similarities in logos weren’t limited to the two-letter

difference in the word element; both used descending font sizes, all caps,

bright colors for “Color” or “Colored,” followed by a duller tone for “copper.com”

And each logo used a pictorial design consisting of four squares in similar,

although not identical, colors and patterns evocative of the underlying copper

products; “indeed, the defendants’ logo of stacked squares looks somewhat like

a person simply shuffled the plaintiffs’ logo squares together. It is entirely

plausible that an ordinary, unsophisticated consumer could be confused by these

similarities.”

Nonetheless, the court cautioned that “defendants’

arguments, although not sufficient to warrant dismissal of the plaintiffs’

claims, raise serious and real issues about the boundaries of the plaintiffs’

rights that may well persist in this case”:

The plaintiffs have no authority to

prevent any competitor from using ordinary language to describe colorful

copper. Nor do they have any right to prevent a competitor from adopting a

non-confusing name or logo that, like theirs, evokes the features of

multicolored copper products. There are, therefore, significant limits to what

the plaintiffs can expect to prevent the defendants from doing. The court’s

holding therefore should not be construed to suggest that the plaintiffs are

likely to establish rights that are nearly as broad as they seek. What matters

for the purposes of Rule 12(b)(6), however, is whether the plaintiffs have

plausibly alleged some trademark infringement, and they have done so. The court

therefore will not dismiss those claims.

A nice statement that should probably guide the parties’

discussions.

Trade dress: Plaintiffs didn’t provide much detail about what

they meant by that; the epoxy websites looked nothing like each other. While

the copper websites looked more similar, “most instances of resemblance arise

out of the use of the allegedly copyright-protected photographs. While those

uses may be illegal under copyright law, it is implausible that those

photographs themselves are distinctive in the marketplace as signals of the

origin of the underlying goods, and the First Amended Complaint provides no

meaningful basis for reaching such a conclusion.” Given the breadth of trade

dress, plaintiffs are under more of a burden to tell courts what they mean when

they use the phrase in pleading infringement. In particular, they should, to

the extent feasible, “separate[ ] out and identif[y] in a list” each of the

“discrete elements which make up th[e] combination” of features that the

plaintiffs seek to protect. They did not do so here, so the court dismissed the

trade dress claims.

False advertising: The allegations identified “merely

describe the supposed underlying trademark infringement.” The plaintiffs

speculated that defendants made false claims about their epoxy, but didn’t

include any factual allegations supporting that. The plaintiffs therefore have

not identified any basis for supporting a claim for false advertising that is

not wholly redundant with their trademark infringement claims.” Dismissed.

Trade name infringement: Not a separate claim. At this stage

in our trademark jurisprudence, “a ‘trade name’ is not a distinct piece of

intellectual property that can be ‘infringed’ distinctly from its

protectability as a trademark.” It may be a distinct concept, but it does not

create a distinct cause of action. Also dismissed.

False designation of origin: This, by contrast, is listed in

the statute, but,

[a]s a practical matter, … the

issue typically comes up ony when the nature of a particular allegation is such

that there may have been a false designation of origin distinct from simply

infringing on another’s trademark and creating confusion about a product’s

source. For example, false designation of origin may come up, distinctly from

trademark infringement, when a seller has falsely attributed a product to a

particular geographic location or particular artisan. Allegations of that sort,

however, are not at issue in this case.

So was this just another label for trademark infringement?

The plaintiffs argued that they were alleging that “Stubenrauch and CV falsely

designated themselves as the authors of the Infringing CV Website and the

Infringing Epoxy Website, as well as the actual services offered on Plaintiffs’

Websites. Thusly failing to properly designate Plaintiffs as the author and the

source of the services being advertised on Plaintiffs’ Websites is a material

misrepresentation as to the origination of the Works embodied in the Infringing

CV Website and the Infringing Epoxy Website which creates a likelihood of

confusion that mistakenly causes the public to draw the conclusion that Mr.

Stubenrauch and CV are the authors of the Works.”

Dastar definitively bars this kind of claim as to

goods. Can plaintiffs successfully characterize this as a claim about services

to evade Dastar? I think plainly not, given that consumers aren’t buying

the service of website design from defendants, and defendants are

in fact both the origin of the goods and of any services related to delivering

the goods—the only things that consumers plausibly buy. The various Sound Choice

cases are pretty clear on this point, which is reinforced by the fact that

the only likely confusion actually alleged in the above quote is about the authorship

of the works.

True, the reference to “services” allowed “a false

designation of origin claim that is redundant with trademark infringement.” I

think the court should have asked “which services have their origin allegedly

falsely designated in this theory?”

Still, that doesn’t matter very much, and the court was very

clear that any claim “based on a false statement of authorship of a creative

work—like a website—should be brought pursuant to copyright laws, not the

Lanham Act.” Thus, the false designation of origin claim was dismissed, without

prejudice to plaintiffs’ ability to rely on “potentially overlapping arguments”

in support of their trademark infringement claims. [A little confusingly

stated, but I think overall it’s clear that the court will allow traditional

trademark claims but not reverse passing off claims based only on the presence

of copied material.]

TCPA: Defendants’ conduct was covered by the TCPA to the

extent that it replicated the Lanham Act claim that survived. They argued,

however, that plaintiffs didn’t sufficiently allege ascertainable loss, as

required by the TCPA. Under that law, “[a]n ascertainable loss is a

deprivation, detriment, or injury that is capable of being discovered,

observed, or established.” This was a potential problem because the parties

were not in competition by the time the defendants took their allegedly

improper actions.

The plaintiffs were only ever in

the colorful copper business because they were distributing the defendants’

products in conjunction with the defendant, and they stopped doing so in

connection with the Wasser situation—not the later alleged infringement. The

plaintiffs, at least according to the story told in the First Amended

Complaint, did not have an independent competing operation that could be harmed

by the infringement in real time. No sale has gone to the defendants that could

have gone to the plaintiffs.

The court thought it was still “possible” to identify an

ascertainable injury in such circumstances, but plaintiffs hadn’t done so.

Conclusory language of injury “might be sufficient in a case in which the facts

themselves make the nature of the underlying damages obvious. In this instance,

however, more explanation was required.” Mere invasion of a right was

insufficient under the TCPA without ascertainable harm.

I ask again, as I often do: why doesn’t this problem also

defeat Article III standing for trademark infringement?

Breach of contract: Dismissed for contract reasons: plaintiffs

didn’t explain what conduct constituted breach.

Conversion: Dismissed because all allegedly appropriated

property was intangible and not subject to the conversion cause of action. Even

ignoring the preempted copying-copyrighted-material allegations, registering a

different, similar domain name does not constitute conversion of an existing

domain name.