Anglo American shares now down 75% since start of 2015 after 8% plunge to fresh record lows

Blue chip miner Anglo American's stock dropped to another record low today, as brokers cut their ratings for the company after the decision to suspend dividends and restructure its business.

In late morning trade, Anglo American shares were down another 8 per cent, or 25.3p to 298.4p, just off a record low of 277.6p reached earlier in the session. Anglo shares have fallen by around 75 per cent since the start of 2015.

Broker Jefferies International today downgraded its rating for Anglo American to underperform from hold, while Renaissance Capital reportedly cut its stance to hold from buy.

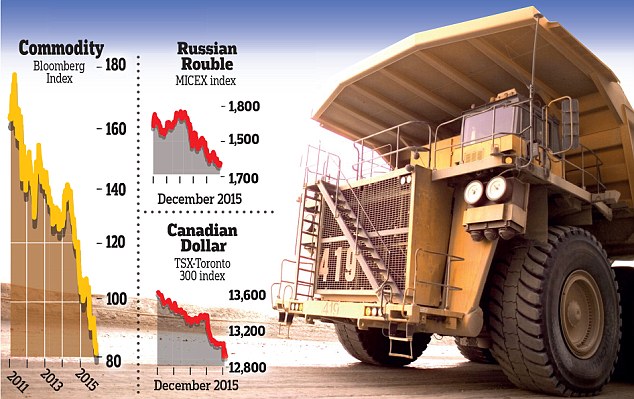

Commodity crisis: The price of iron ore – which is used to make steel – fell to a decade low below $40 a ton and Brent crude oil sank to a seven-year low of below $40 a barrel

The commodity rout claimed its latest victim yesterday when Anglo American revealed a ‘radical’ restructuring plan involving 85,000 job cuts.

In a bruising setback for investors, the mining giant also suspended its dividend and announced plans to close and sell many of its mines as it struggles to cope with the unrelenting fall in metal prices.

Anglo shares crashed more than 12 per cent to a record low as more than £5billion was wiped off FTSE 100 mining stocks.

Yesterday's sell-off also came after weak Chinese trade data reignited fears of a global economic slowdown and sent commodity prices tumbling.

The price of iron ore – which is used to make steel – fell to a decade low below $40 a ton and Brent crude oil sank to a seven-year low of below $40 a barrel.

The Bloomberg commodity index hit a 16-year low.

Commodities have been hammered on worries about China. China accounts for around half of global demand for metals such as copper, nickel and aluminium.

Tony Cross, market analyst at online trading firm Trustnet Direct, said: ‘Natural resources stocks really have had a torrid year and it’s difficult to try and call an end to the slide.’

According to Trustnet, more than £100billion has been wiped off the value of the mining sector since June 2011 when trading giant Glencore floated.

The major producers of iron ore such as Rio Tinto and BHP Billiton have continued production to price out smaller rivals.

Anglo, although significant in size, has suffered due to its higher-cost iron ore operations. However the declines are so great many analysts are not clear how much more the market can stand.

Michael Hewson, chief market analyst at CMC Markets UK, said: ‘At the beginning of this year Sam Walsh, chief executive of Australian giant Rio Tinto, asserted that the prospect of $30 a ton iron ore was in the realms of fantasy land, and would never be reached.

'Given that we are now $9 away this fantasy could well be about to turn into a nightmare.’

Anglo American’s decision to suspend its dividend until the end of next year is major blow to shareholders.

Mark Cutifani, chief executive of Anglo, which was founded in 1917 by mining mogul Ernest Oppenheimer, said: ‘No one likes to suspend a dividend, because for shareholders we understand how difficult that is.

'It was a tough one, but we have always said it remained a line of defence that if required we would have to call, and that’s what we’ve done.’

Anglo had already announced sweeping cuts but the severe shake-up announced yesterday went even further and includes flogging three-fifths of its assets – leaving it with just over 20 – and cutting its workforce to just 50,000 from 135,000.

It has halved the number of divisions to three: diamond arm De Beers, industrial metals and bulk commodities. The sell-off will raise more than £2.6billion and it has drastically reduced spending and costs.

Anglo is not alone and in September Glencore suspended its dividend, put £1.3billion of assets up for sale, raised £1.6billion in a share placing and plans to cut its debts by £7billion before the end of next year to close to £13billion.

Commodity-linked currencies are also suffering. The Canadian dollar fell to a 11-year low and the Russian rouble and Norway’s krone continued to decline.

Most watched Money videos

- Three fund ideas for investors to profit in a volatile 2025

- The new two-door two-seater Aston Martin Vantage Roadste

- Share picks for 2025: From Nvidia to a FTSE stalwart

- Famous 1986 Land Rover Defender advert that saw a car climb a dam

- 1987 Volkswagen advert champions the reliability of their cars

- Boreham Motorworks unveils the limited-edition Mk1 Ford Escort

- Mercedes-Benz launch wacky advert of a dancing chicken

- Relive the iconic Renault Megane advert from 2005

- Dean Dunham responds to a man who has rented council land since 1975

- Snoop Dogg in film announcing Publicis as largest advertising agency

- Jaguar targets new customers by ditching logo and going electric

- Toyota relaunches Urban Cruiser as an electric tech-rich crossover

-

Oh for the days when a fish supper was 35p! As Rick Stein...

Oh for the days when a fish supper was 35p! As Rick Stein...

-

FTSE 100 tops 8,500 to hit new record on hopes of rate...

FTSE 100 tops 8,500 to hit new record on hopes of rate...

-

Cash Isa battle sees Trading 212 hike best rate TWICE in...

Cash Isa battle sees Trading 212 hike best rate TWICE in...

-

Banks could offer more large mortgages as Labour urges...

Banks could offer more large mortgages as Labour urges...

-

Backlash against Freetrade deal intensifies as chief...

Backlash against Freetrade deal intensifies as chief...

-

Three fund ideas for 2025: Expert picks on bonds, US...

Three fund ideas for 2025: Expert picks on bonds, US...

-

Chancellor urged to rule out fresh pension tax raid

Chancellor urged to rule out fresh pension tax raid

-

Polestar 7 confirmed - and it'll be a premium compact SUV EV

Polestar 7 confirmed - and it'll be a premium compact SUV EV

-

RAY MASSEY: Dacia finally reveals Bigster price range

RAY MASSEY: Dacia finally reveals Bigster price range

-

Retail sales shrink over crucial festive trading period

Retail sales shrink over crucial festive trading period

-

Everyman suffers box office slump as Joker sequel...

Everyman suffers box office slump as Joker sequel...

-

How much money are homeowners now making when they sell?...

How much money are homeowners now making when they sell?...

-

William Hill owner Evoke on a roll as turnaround strategy...

William Hill owner Evoke on a roll as turnaround strategy...

-

SMALL CAP MOVERS: Fiinu agrees AI deal with UK bank

SMALL CAP MOVERS: Fiinu agrees AI deal with UK bank

-

DFS on track to double profits - but furniture demand...

DFS on track to double profits - but furniture demand...

-

Rio Tinto talks with Glencore to trigger merger mania

Rio Tinto talks with Glencore to trigger merger mania

-

MARKET REPORT: US activist investor takes pot shot at...

MARKET REPORT: US activist investor takes pot shot at...

-

Goldman boss given £67m bonus to remain in role for five...

Goldman boss given £67m bonus to remain in role for five...